This post looks at two important Brexit-related Bills: the Taxation (Cross-Border) Trade Bill 2017-19 and the Trade Bill 2017-19.

Taxation (Cross-Border) Trade Bill:

Sometimes referred to as "the Customs Bill", the government's Taxation (Cross-Border) Trade Bill 2017-19 allows

the creation of a functioning and independent customs, VAT and excise

regime after Brexit. It is a Bill to -

On Monday 16 July, after a vociferous debate, the Bill received its Third Reading in the Commons (318 votes to 285) and will now go to the Lords. Here is the Bill as at 17 July - HL Bill 125 (as introduced) (PDF, 692KB)

There are "Ways and Means" resolutions applicable to this Bill

A Supply Bill:

This Bill is classed as a "Supply Bill" - HERE - The House of Lords cannot amend Supply Bills so committee stage, report stage and third reading are just formalities. The basis for this is explained in this report of the Constitution Committee. Supply Bills are identified by a special enactment formula. - shown after the words "Most Gracious Sovereign ..."

Important Commons amendments:

The notable feature of the proceedings on Monday 16 July was the acceptance by the government of certain amendments put forward by the influential faction of Conservative MPs - the so-called European Research Group (ERG) - BBC News 17 July and this has led some to believe that the White Paper (discussed here) is now dead - The Independent 16 July.

A useful article on the events of 16 July is at Brexit Central and also Politics.co.uk - Ian Dunt 16 July - Government capitulation today could all but guarantee no deal

Consideration of Bill Amendments as at 16 July 2018 | PDF version, 348KB

The details:

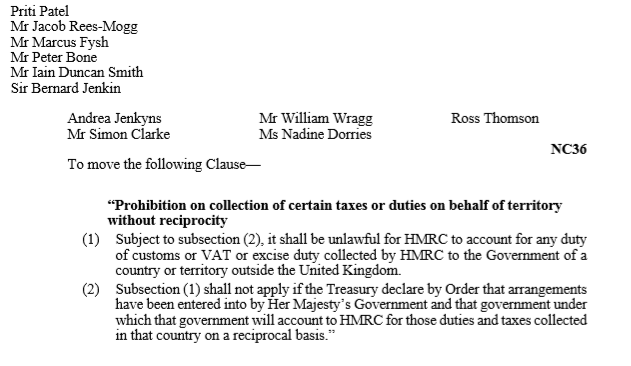

A) One amendment prevents collection of duties for any other country BUT the Treasury can permit it where the other country collects duties / taxes on a reciprocal basis. This amendment has now become Clause 54 in the Bill as presented to the House of Lords - HL Bill 125 (as introduced) (PDF, 692KB)

B) A further amendment prevents Northern Ireland being part of a separate customs territory to Great Britain. The Prime Minister is on record as saying that a customs border between Northern Ireland and Great Britain - (in effect a border down the Irish Sea) - would not be acceptable. This amendment appears to prevent the so-called "back stop" option in the Draft Withdrawal Agreement entered i to in March 2018.

The draft Withdrawal Agreement contained a Protocol on Northern Ireland - discussed here. The Protocol is an integral part of the agreement. As a House of Commons Library Research Briefing points out:

Here is the amendment - which has now become Clause 55 in the Bill as presented to the House of Lords - HL Bill 125 (as introduced) (PDF, 692KB)

There are "Ways and Means" resolutions applicable to this Bill

A Supply Bill:

This Bill is classed as a "Supply Bill" - HERE - The House of Lords cannot amend Supply Bills so committee stage, report stage and third reading are just formalities. The basis for this is explained in this report of the Constitution Committee. Supply Bills are identified by a special enactment formula. - shown after the words "Most Gracious Sovereign ..."

Important Commons amendments:

The notable feature of the proceedings on Monday 16 July was the acceptance by the government of certain amendments put forward by the influential faction of Conservative MPs - the so-called European Research Group (ERG) - BBC News 17 July and this has led some to believe that the White Paper (discussed here) is now dead - The Independent 16 July.

A useful article on the events of 16 July is at Brexit Central and also Politics.co.uk - Ian Dunt 16 July - Government capitulation today could all but guarantee no deal

Consideration of Bill Amendments as at 16 July 2018 | PDF version, 348KB

The details:

A) One amendment prevents collection of duties for any other country BUT the Treasury can permit it where the other country collects duties / taxes on a reciprocal basis. This amendment has now become Clause 54 in the Bill as presented to the House of Lords - HL Bill 125 (as introduced) (PDF, 692KB)

B) A further amendment prevents Northern Ireland being part of a separate customs territory to Great Britain. The Prime Minister is on record as saying that a customs border between Northern Ireland and Great Britain - (in effect a border down the Irish Sea) - would not be acceptable. This amendment appears to prevent the so-called "back stop" option in the Draft Withdrawal Agreement entered i to in March 2018.

The draft Withdrawal Agreement contained a Protocol on Northern Ireland - discussed here. The Protocol is an integral part of the agreement. As a House of Commons Library Research Briefing points out:

UK Government’s favoured option, is for

the Irish border issue to be settled as part of the overall UK - EU future

relationship. The second is that the UK will propose specific solutions to

solve the Irish border issue. The third is where there is no agreed solution;

in these circumstances the Joint Report committed the UK to: Maintain full

alignment with those rules of the Internal Market and the Customs Union which,

now or in the future, support North-South cooperation, the all-island economy

and the protection of the 1998 Agreement. The Protocol on Ireland and Northern

Ireland is the EU’s legal text for how this third or ‘backstop’ scenario could

operate.

At the heart of the difficulties over Northern Ireland is that any proposed solution needs to try and reconcile three seemingly irreconcilable objectives:

* Avoiding a hard border in Ireland, including physical infrastructure to carry out customs and regulatory checks on goods flowing in either direction

*Allowing the UK to diverge from EU regulations

*Avoiding regulatory divergence between Northern Ireland and the rest of the UK.

At the heart of the difficulties over Northern Ireland is that any proposed solution needs to try and reconcile three seemingly irreconcilable objectives:

* Avoiding a hard border in Ireland, including physical infrastructure to carry out customs and regulatory checks on goods flowing in either direction

*Allowing the UK to diverge from EU regulations

*Avoiding regulatory divergence between Northern Ireland and the rest of the UK.

Here is the amendment - which has now become Clause 55 in the Bill as presented to the House of Lords - HL Bill 125 (as introduced) (PDF, 692KB)

Trade Bill:

The government's Trade Bill 2017-19 is a Bill to -

On Tuesday 17 July, the Bill received its Third Reading in the Commons (317 votes to 286) - see the debate on 17 July - and will now go to the Lords. Here is the Bill as at 18 July - HL Bill 127 (as introduced) | PDF version, 163KB

For the amendments see - Consideration of Bill Amendments as at 17 July 2018 | PDF version, 291KB

On the events of 17 July see CityAM

Brexit Time - 20 July - Brexit's Bitter Pill - How significant was the government's defeat on the Trade Bill amendment - This article refers to an amendment that is now Clause 6 in the Bill -

The government's Trade Bill 2017-19 is a Bill to -

On Tuesday 17 July, the Bill received its Third Reading in the Commons (317 votes to 286) - see the debate on 17 July - and will now go to the Lords. Here is the Bill as at 18 July - HL Bill 127 (as introduced) | PDF version, 163KB

For the amendments see - Consideration of Bill Amendments as at 17 July 2018 | PDF version, 291KB

On the events of 17 July see CityAM

Brexit Time - 20 July - Brexit's Bitter Pill - How significant was the government's defeat on the Trade Bill amendment - This article refers to an amendment that is now Clause 6 in the Bill -

No comments:

Post a Comment